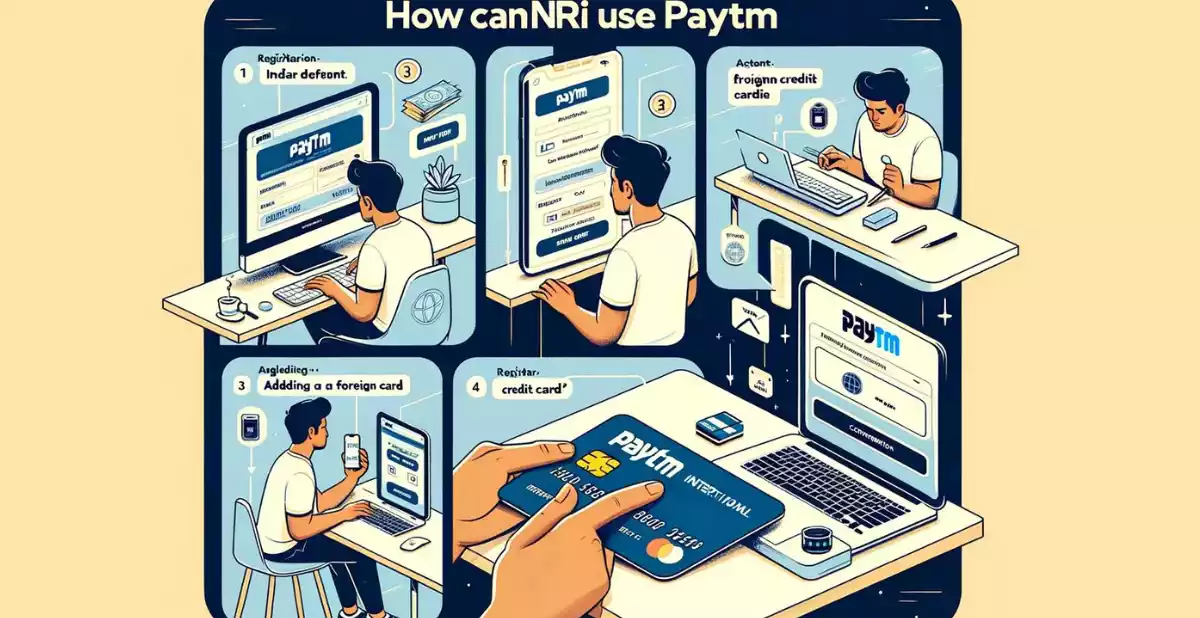

Paytm, a major player in India’s digital payment ecosystem, offers various services that NRIs can utilize. While Paytm Money does not currently offer NRI trading and Demat services, in this article we will talk about How Can NRI Use Paytm and the benefits of using online payment system. NRIs can use their international debit and credit cards for shopping and other payments in India.

Understanding UPI for NRIs

Unified Payments Interface (UPI) is a system that integrates several banking features, including fund routing and merchant payments, into a single platform for any participating bank. UPI has become extremely popular in India for retail digital payments.

How Can NRI Use Paytm

Paytm Money does not offer trading and Demat services for NRIs, meaning an NRI cannot open an account in Paytm Money. However, NRIs can use Paytm for other services like shopping and paying for services while in India

Recent Developments for NRIs Using UPI

The National Payments Corporation of India (NPCI) has made significant changes to allow NRIs to access UPI services. Now, NRIs living in certain countries can use UPI to send and receive money using their international mobile numbers.

Countries Eligible for NRI UPI Services

The service is currently available to NRIs from the following countries:

- Australia

- Canada

- Hong Kong

- Oman

- Qatar

- Saudi Arabia

- Singapore

- United Arab Emirates (UAE)

- United Kingdom (UK)

- United States (US)

Requirements for Using UPI as an NRI

- NRE/NRO Account: NRIs need to have either a Non-Resident External (NRE) or Non-Resident Ordinary (NRO) account to use UPI services.

- International Phone Number: NRIs can link their international phone numbers to their UPI accounts, eliminating the need for an Indian mobile number.

Benefits for NRIs Using UPI

- Ease of Payments: NRIs can easily make payments to Indian merchants accepting UPI.

- Money Transfers: Sending money to family and loved ones in India has become more convenient.

- Investment: NRIs can invest in India without relying on internet banking.

- Auto-Pay for Recurring Expenses: Useful for managing expenses for a family in India.

| Feature | Description |

|---|---|

| Eligible Countries | Australia, Canada, Hong Kong, Oman, Qatar, Saudi Arabia, Singapore, UAE, UK, US |

| Required Accounts | NRE or NRO accounts |

| Phone Number | International mobile number linkable to UPI |

| Key Benefits | Ease of payments, convenient money transfers, investment facilitation, management of recurring expenses |

The integration of UPI with international numbers for NRIs marks a significant step in making financial transactions in India more accessible and convenient for the NRI community. It not only facilitates easy payments and transfers but also opens up avenues for investments and managing expenses in India. This move by NPCI is a game-changer in the digital payment space, enhancing the user experience for millions of NRIs across the globe. The inclusion of more countries in the future will further expand the reach and utility of UPI, making it a truly global payment system.